- #BUSINESS FINANCE CALCULATOR INSTALL#

- #BUSINESS FINANCE CALCULATOR PLUS#

- #BUSINESS FINANCE CALCULATOR WINDOWS#

SBA loan terms normally have a span of seven, 10 or 25 years, depending on the specifics of the loan.

The results should reveal the monthly payment you may receive. When you’ve established an amount and figured out an interest rate, you can fill in the appropriate fields on the SBA loan calculator. With fixed rate loans, the SBA uses a multi-step process to determine the maximum fixed interest rate. A term that is seven years or more will be subject to slightly higher SBA loan interest rates, but the spread can be no more than 4.75%. Usually, the borrower and the lender can negotiate interest rates, but the SBA sets a maximum spread to protect borrowers - a spread is essentially a percentage that a bank can make off a loan.įor variable 7(a) loans that have a term of less than seven years, the spread on SBA interest rates is between 2.25% and 4.25% add that to the current Prime rate for your total interest rate. Interest rates for SBA 7(a) loans can be either fixed or variable. Once you’ve determined the amount you’d like to borrow, you’d need to input the percentage of your loan rate into the SBA loan calculator. SBA loans, specifically the popular SBA 7(a) loans, typically have a maximum amount of $5 million, providing business owners with the ability to secure a large amount of funding for their business. Using an SBA loan calculator to figure out how much money you can afford to borrow is the first step to determining the monthly payments.

There are three main factors to an SBA loan payment: loan amount, interest rate and loan term.

#BUSINESS FINANCE CALCULATOR WINDOWS#

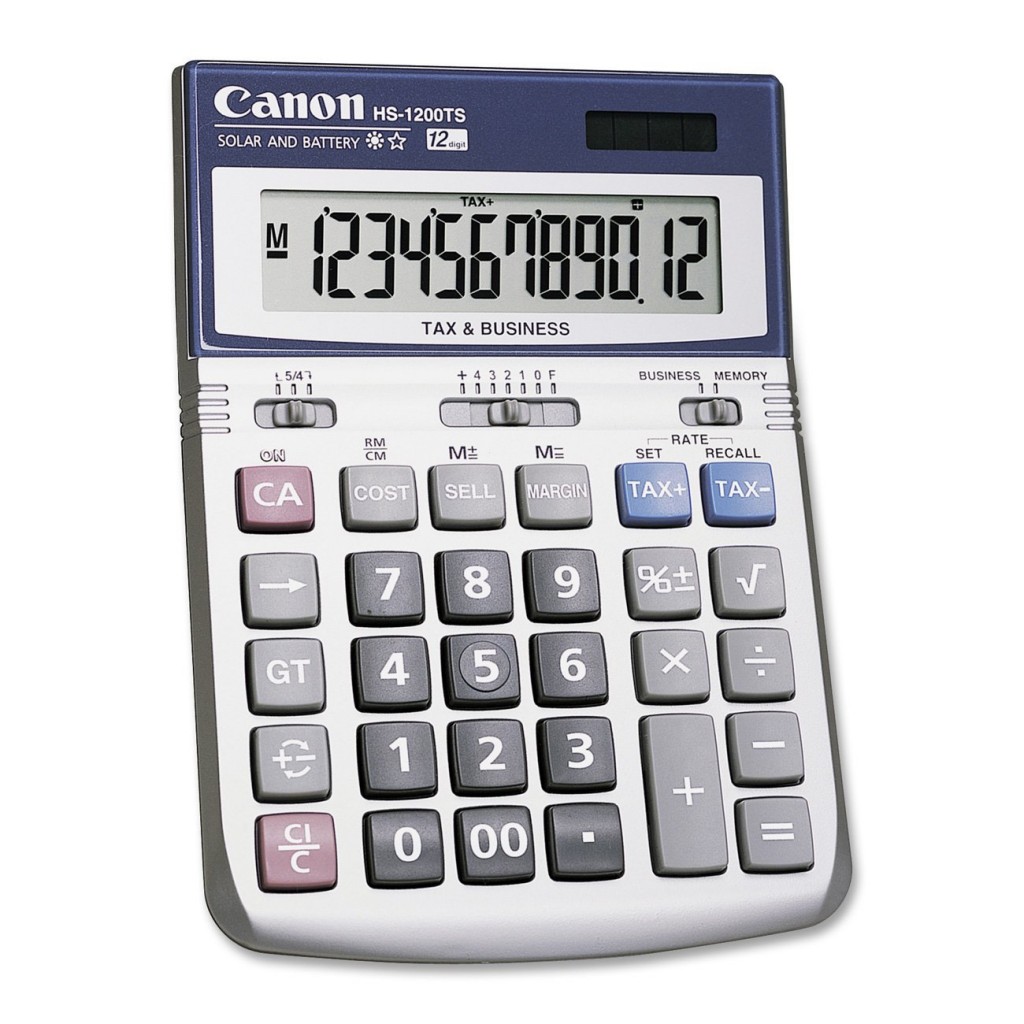

Record cash flows as they happen and track balances. Loans, payments, deposits, withdrawals and interest rate changes can be adjusted to occur on any date. Create custom debt or investment cash flows. Record payments and track balances on loans. C-Value! Wizard for Windows - A loan and mortgage payoff calculator.How many units of your product must be sold to make a profit? Break Even Point Analysis for Windows - calculate break-even sales point for product or business.

#BUSINESS FINANCE CALCULATOR PLUS#

These are some of the 40 plus calculators included in SolveIT!.

#BUSINESS FINANCE CALCULATOR INSTALL#

† Displays and prints nicely formatted schedules & charts.įor Windows - download & install SolveIT! on your computer Return on Investment ( ROI ) - exact ROI between two dates.Percentage Calculations - 4 calculators.Uniquely calculates explicit and implicit percentages. Markup / Discount Percentages - Calculate profit margins.† MACRS Depreciation Calculator - per IRS Publication 946, "How to Depreciate.".Modified Internal Rate of Return ( MIRR ) - another way to look at return on investments.Solve for exact balance or early payoff date, † Loan Payoff Calculator - enter payments on date paid and track late, missed and extra payments.Supports normal loans as well as Rule-of-78s and fixed principal payment loans. † Loan Calculator - solve for payment, term, rate or loan amount.Internal Rate of Return ( IRR ) - Return on investment calculation for adjustable cash flow.Interest Calculations - calculate periodic or exact date interest.† Break-Even Point Calculator - easily calculate your break-even point (BEP).Online - free, nothing to download or install.

0 kommentar(er)

0 kommentar(er)